DISCOVERY HEALTH’S 2020 MEDICAL AID INCREASES

Total monthly contributions for plans in the Discovery Health Medical Scheme (DHMS) will increase by between 8.88% and 10.96% for main members from January.

The increases are mostly skewed to the higher-end plans, with those in the Comprehensive range and the Executive plan increasing by very close to 11%. Discovery contends that “Only 19% of members will have the 10.9% increase, while 60% of members will have an 8.9% increase.

One outlier is the lowest income band of the most comprehensive of the entry-level KeyCare plans, KeyCare Plus (R0-R8550), which increases by a similar amount.

With the exception of the Coastal Core plan (9.94%) and Coastal Saver Plan (9.9%), contributions for all other plans will increase by just under 9%.

The Classic Comprehensive Zero MSA (no medical savings account) plan falls away. In its place is the Classic Smart Comprehensive plan, also with no medical savings account. Exact differences between the two are not immediately apparent from the pricing table.

Discovery cites a market survey of financial advisors representing over 250 000 lives, which shows that market expectations are for increases between 10% and 12% across the industry.

“Following the success of its digitally enabled, network-based Smart Series, the Scheme has extended the design to its Comprehensive Series, to offer families attractive options for efficient, affordable comprehensive cover in 2020.”

According to a pricing document made available to brokers, the weighted average increase is 9.5%. This takes into account contributions for main members, adults and children. DHMS generally shares price changes publicly in October/November.

| Plan | 2019 | 2020 | Increase |

| Executive Plan | R6 541 | R7 257 | 10.95% |

| Classic Comprehensive | R5 368 | R5 954 | 10.92% |

| Classic Delta Comprehensive | R4 834 | R5 362 | 10.92% |

| Essential Comprehensive | R4 509 | R5 003 | 10.96% |

| Essential Delta Comprehensive | R4 062 | R4 507 | 10.96% |

| Classic Smart Comprehensive | – | R4 327 | – |

| Classic Priority | R3 501 | R3 814 | 8.94% |

| Essential Priority | R3 010 | R3 278 | 8.9% |

| Classic Saver | R3 021 | R3 290 | 8.9% |

| Classic Delta Saver | R2 412 | R2 628 | 8.96% |

| Essential Saver | R2 400 | R2 615 | 8.96% |

| Essential Delta Saver | R1 915 | R2 085 | 8.88% |

| Coastal Saver | R2 373 | R2 608 | 9.9% |

| Classic Smart | R1 794 | R1 954 | 8.92% |

| Essential Smart | R1 285 | R1 400 | 8.95% |

| Classic Core | R2 248 | R2 449 | 8.94% |

| Classic Delta Core | R1 799 | R1 960 | 8.95% |

| Essential Core | R1 931 | R2 104 | 8.96% |

| Essential Delta Core | R1 543 | R1 681 | 8.94% |

| Coastal Core | R1 770 | R1 946 | 9.94% |

| KeyCare Plus R0 – R8 550 | R1 088 | R1 207 | 10.94% |

| KeyCare Plus R8 551 – R13 800 | R1 523 | R1 659 | 8.93% |

| KeyCare Plus R13 801+ | R2 249 | R2 450 | 8.94% |

| KeyCare Core R0 – R8 550 | R871 | R949 | 8.96% |

| KeyCare Core R8 551 – R13 800 | R1 086 | R1 183 | 8.93% |

| KeyCare Core R13 801+ | R1 661 | R1 809 | 8.91% |

| KeyCare Start R0 – R9 150 | R839 | R914 | 8.94% |

| KeyCare Start R9 151 – R13 800 | R1 412 | R1 538 | 8.92% |

| KeyCare Start R13 801+ | R2 198 | R2 394 | 8.92% |

Given DHMS’s position in the market – it held 56.6% market share of members in September 2018, according to the Council for Medical Schemes – these price changes are far-reaching. It nonetheless continues to grow. In 2018, it added a net 41 193 members, versus a combined 9 048 decline for the next seven largest schemes (Bonitas, Momentum Health, Medihelp, BestMed, Medshield, Fedhealth, and Sizwe).Last year, DHMS attempted to consolidate the income bands for its entry-level KeyCare plans. On KeyCare Core and KeyCare Plus, it removed the middle income bracket, and on KeyCare Start, it consolidated the lower two brackets. This meant increases of between 20% and 47% for some members. It reversed the plan to consolidate these after a strong backlash. The same brackets as 2019 remain in force next year.

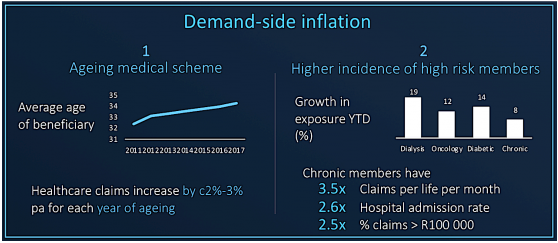

According to its annual results presentation, medical inflation from July 2018 to end-June 2019 was 10.6%. Over the past decade, this has been 10.9%, with both supply and demand-side factors contributing to the rate which is more than double the Consumer Price Index (CPI).

Discovery Health estimates total medical inflation for 2019 at between 10.5% and 12.5%, with the variance due to utilisation trends on the different health plan options. However, risk management by Discovery Health and the ongoing positive impact of Vitality on engaged members’ health, reduce medical inflation by 1.6%, resulting in plan specific contribution increase

s between8.9% and 10.9%.

Because of its size and overall population dynamics, the average age of its member is trending up over time.

As members get older, there is an increase in claims. Higher-risk members also drive up demand-side inflation.

Source: Hilton Tarrant – Moneyweb

Date

September 16, 2019

Author

The Wealth Room

Share This Project

Tags: finance, financial coaching, Grant van Zyl, Old Mutual

Leave a Comment